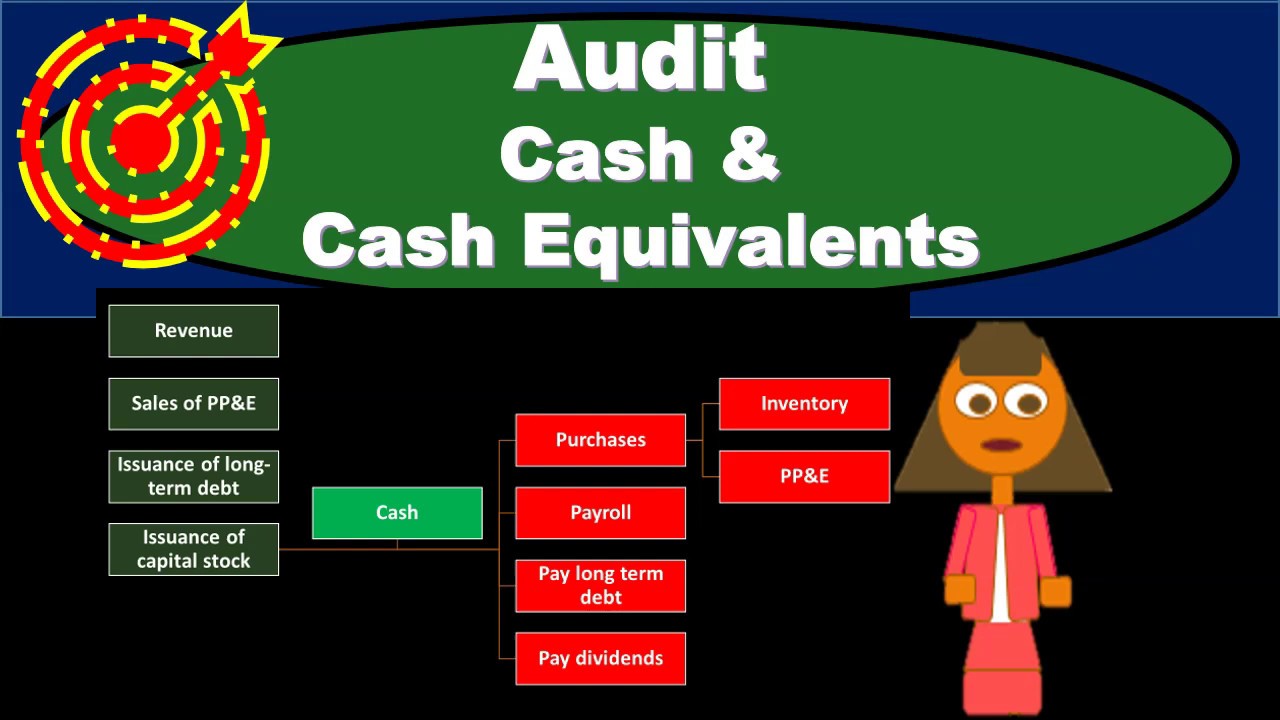

Audit Procedures for Cash and Cash Equivalents

AUDIT PROCEDURES FOR CASH CASH EQUIVALENTS MODULE CONTENTSOBJECTIVES. Identify the basic audit procedures over the cash process including those surrounding risk and fraud.

Cash Audit Procedures Assertions Objectives Management Cash Exists Include All Transactions That Should Be Presented Represents Rights Of The Entity Ppt Download

Identify the risk of fraud related to cash and cash equivalents.

. Assess the internal control structure surrounding cash. The auditor will need to. Check and agree the.

Recall the audit objectives and related assertions in the cash and cash equivalents area. 6 rows Audit Procedures for testing Cash and Cash Equivalents include Test of Controls and. Audit Assertion for Cash and Cash Equivalent.

Recall the audit objectives and related assertions in the cash and cash equivalents area. Comparing the detail of cash receipts as shown by the cash receipts records with the detail on the confirmed duplicate deposit tickets for 3 days prior to and subsequent to year end. CPA Engagement Lead-Risk Identified-procedures-Cash Cash-equivalent June 2015 Description.

How to Audit Cash and Cash Equivalent. The cash must exist under company control at the reporting in. Sending Confirmations to all the bank accounts either physically or.

Identify the steps for risk assessment and identify the common risks found in the cash and cash. Perform a risk assessment over cash and cash equivalents. Techniques used to perform the audit.

A substantiate the existence of recorded cash and the occurrence of cash transactions. Download Audit Of Cash And Cash Equivalents. Audit procedures for cash.

Key Audit Procedures for Cash and Bank Audit The first important task for the auditor is to get a clear understanding of the clients policy and procedure for cash. 1 Audit Objective The objective of this template is to ensure the Completeness. Audit of Cash and Cash Equivalents.

Cash recorded on the books exist-Count cash on hand-Confirm bank. Describe designing a detailed audit plan linking assessed risk to planned procedures. Cash receipts should be deposited intact that is in the same.

AUDIT OF CASH AND CASH EQUIVALENTS SUBSTANTIVE AUDIT PROCEDURES FOR CASH Cash Balances Existence. 4 rows Following procedures are usually used for bank reconciliation in audit cash. The following are the substantive audit procedures for cash.

The principal objectives of the substantive procedures for cash are to. Up to 3 cash back Audit Procedures The bank will confirm the balances as per their record and it is usual that the amount the bank confirmed will not match with the organizations bank. After completing this course the learner should be able to.

This video lecture discusses the audit of cash and cash equivalents particularly the substantive procedures to be performed on the said line item. Internal Control Measures and Substantive Audit Internal Control Measures for Cash 1. This document was uploaded by user and they confirmed that they have the.

Audit Of Cash And Bank Balances

Cash Audit Procedures Assertions Objectives Management Cash Exists Include All Transactions That Should Be Presented Represents Rights Of The Entity Ppt Download

No comments for "Audit Procedures for Cash and Cash Equivalents"

Post a Comment